SnapRefund

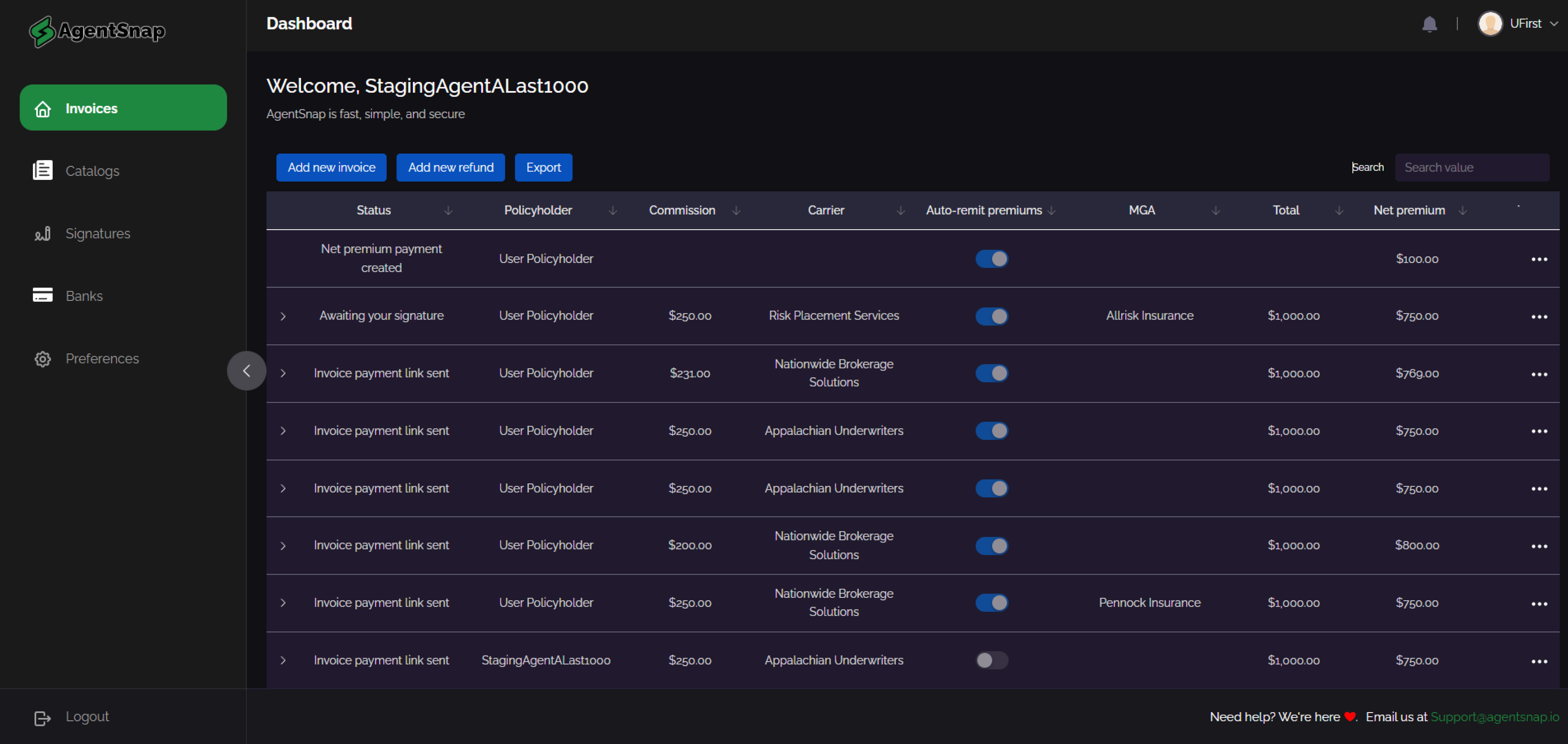

AgentSnap makes selling and binding agency billed policies as easy as sending a link to your customer’s phone.

Project

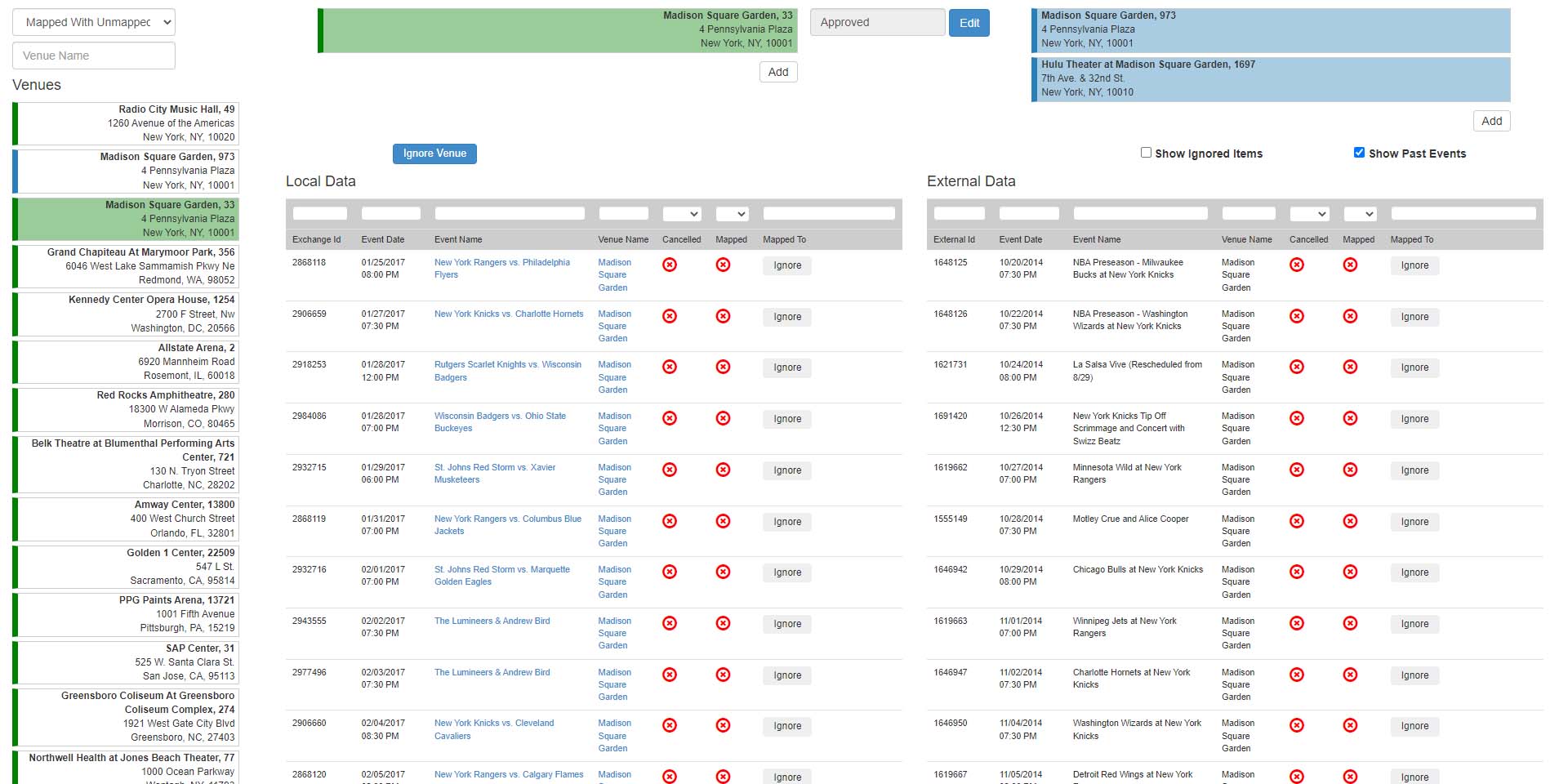

AgentSnap is an agency-billing and policy binding platform for insurance Agents, existing within SnapRefund’s portfolio of synergistic insurance technology. Insurance agencies benefit from AgentSnap’s core fintech services framework to easily collect payments from customers, bind signatures, and automate reconciliation. AgentSnap makes agency billing fast, simple, and secure.

Challenge

The biggest challenge of the project is to make sure that external providers like Dwolla, Stripe, CheckFlo, SignNow, and others are working as one unified system. The complexity of onboarding in the insurance industry also creates a challenge of providing a seamless onboarding flow that also meets SOC2 and PCI DSS compliance rules.

Solution

The combination of Dwolla, Stripe, and CheckFlo APIs helps to cover most of the use cases with the best outcomes for the users. A custom onboarding process and communication with third-party services via API help to avoid storing user-sensitive data and reduce the system's compliance burden. However, the system also required the implementation of the basic compliance frameworks.

Results

Seemless onboarding process for insurance agents, multiple ways to pay to the policyholders and carriers depending on their preference as well as premium financing options and real time payments were implemented. Additionally, the system supports a standalone document signing process through SignNow.

Related projects

Our Services and Solutions

Read More